The Stock Market Today, Banknifty, SBIN. Banknifty opened at 41740 which is a gap-up of 482 points compared with the previous close at 41258. The SBIN has created its record high.

Banknifty

Since 41600 to 41800 is look critical level for the Banknifty hence it was expected that the Banknifty may perform with high volume like gap-up/gap-down at the current level.

Today 07/11/2022, the Banknifty opened with a gap-up of 482 points and it was close to the 41800 level which seems to be strong resistance hence fall after opening was expected.

After when today’s market opened, the Banknifty made a small high of 41779, and then the fall started.

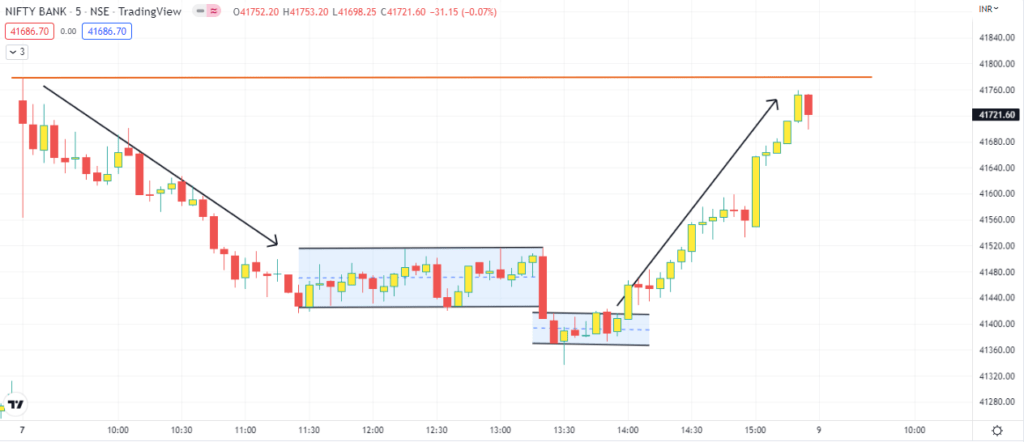

In the above today’s banknifty chart, we can see that for half of the session the market was in bearish movement, the market continue down from 41779 to 413337.

There was a consolidated movement at one point between 11.30 AM to 01:20 PM, but then after crossing the consolidated movement below, there was a sudden spike seen and then the next half of the session market was in bullish movement but did not touch or crossed today’s high point which was at 41779.

As mentioned above the 41600 to 41800 is looking critical level for the banknifty hence there was a doubt if the banknifty crosses the 41800 level.

However, the market closed close to the high point, if we look at the 1-day candle chart, then we can see the market closed at its resistance level, the pick point.

What Next Possibility in Banknifty?

It seems there is a high selling pressure between 41600 to 41800 hence if the market really likes to go up then there is a possibility that the market may give a gap-up opening above 41800/41900.

Positive Side

After the gap-up opening above 41800/41900, the seller may square off their position and the buyer may take a lead which further takes Banknifty to more up.

Negative Side

As we already mentioned range between 41600 to 41800 is very critical hence till the market is below 41800-41900, the possibility is a fall.

If the market gives a gap-up opening then it is important to sustain the above. If the market does not sustain then it’s already at a triple top level so fall can be expected.

STATE BANK OF INDIA (SBIN)

SBIN has outperformed today, below are the key points according to quarter results (Q2FY23) submitted to Exchange on 05/11/2022.

Profitability

• Highest ever quarterly Net Profit at Rs. 13,265 crores; grew by 73.93% YoY.

• Operating Profit for Q2FY23 at Rs. 21,120 crores; grew by 16.82% YoY.

• ROA at 1.04% for the quarter improved by 38 bps YoY.

• Bank’s ROA and ROE for the half year stand at 0.76% and 16.08% respectively.

• Net Interest Income (NII) for Q2FY23 increased by 12.83% YoY.

• Domestic NIM for Q2FY23 increased by 5 bps YoY to 3.55%.

Balance Sheet

• Credit growth at 19.93% YoY with Domestic Advances growing by 18.15% YoY.

• Foreign Offices’ Advances grew by 30.14% YoY.

• Domestic Advances growth driven by Corporate Advances (21.18% YoY) followed by

Retail Personal Advances which grew by 18.84% YoY.

• REH Advances cross Rs. 6 lakh crores.

• SME and Agri loans have registered YoY growth of 13.24% and 11.00% respectively.

• Whole Bank Deposits grew at 9.99% YoY, out of which CASA Deposit grew by 5.35%

YoY. CASA ratio stands at 44.63% as on 30th September 22.

Asset Quality

• Net NPA ratio falls below 1%, stands at 0.80% down by 72 bps YoY.

• Gross NPA ratio at 3.52% down by 138 bps YoY.

• Provision Coverage Ratio (PCR) at 77.93% improved by 788 bps YoY, PCR (Incl.

AUCA) stands at 91.54%.

• Slippage Ratio for Q2FY23 at 0.33% improved by 33 bps YoY.

• Credit Cost for Q2FY23 at 0.28%; improved by 15 bps YoY.

Capital Adequacy

• Capital Adequacy Ratio (CAR) as at the end of Q2FY23 stands at 13.51%.

Alternate Channels

• 62% of SB accounts and 45% of retail asset accounts acquired digitally through YONO.

• Share of Alternate Channels in total transactions increased from 95.1% in H1FY22 to

96.8% in H1FY23.

Looking at the massive growth of SBIN, according to various sources. it is forecasted that the SBIN price may go up to 760-770,

You must also read.

Stock Market, Nifty50 & BankNifty Review.

Five Star Business Finance IPO | Do You Know?

Yes Bank May close Stressed Asset This Month.