About Zerodha Broker

Zerodha is a Stock broker in India. Zerodha is currently one of the largest brokers in India gaining 1+ Crore clients who daily contribute to over 15% of retail order volumes in India by trading and investing in multiple assets.

Zerodha has its own developed online trading platform called Kite which is built on advanced technology, more focused on light weighted and user-friendly online trading platform. You can not directly use the Kite platform as it requires a client id and password which you will receive after opening an account.

In Zerodha What Asse ts You Can Trade And Invest in?

Zerodha’s users can trade and invest in the below assets that are available on their online trading platform Kite.

- Stocks

- IPOs

- Futures and Options

- Commodity derivatives

- Currency derivatives

- Direct mutual funds

- Bonds and Govt. Securities

Overview Of Zerodha Online Trading Platform KITE.

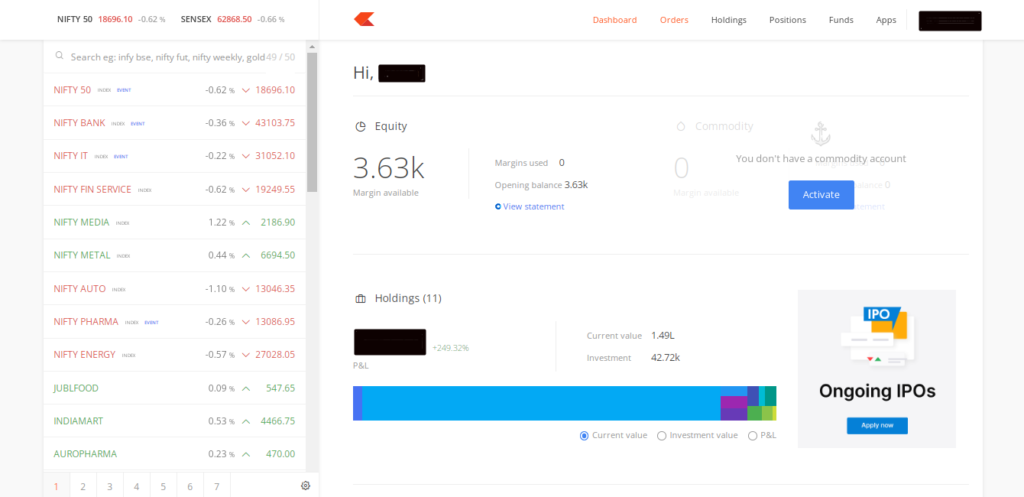

Once your account opening procedure is completed, you will get the login details that you can use to access the Kite platform. After login into the Kite, you will get the below view.

Dashboard

The dashboard provides you below details.

- Available Funds (Margin available) that you can use for trade and investment.

- A number of stocks in a total holding.

- Your current Profit and Loss (P&L) in Holdings.

- The total invested amount and its current value.

Orders

The orders section list all your Buy and Sell order that you have placed at a particular price.

Holdings

The holdings section list all the stocks that you have brought and still hold. Each stock under holdings gives you the below details.

- Total quantity you brought.

- Avg cost means the price where you brought the stock.

- LTP means Live Trading Price which means the stock’s current price.

- Current value based on Avg cost and LTP.

- P&L means total profit and loss.

- Net change means total growth % from when you brought the stock to till date.

- Day change means stock today’s performance growth %.

Positions

In the positions section, you will see your current active trade, its profit, and loss. If you sell any stock from holding, after selling it will list in the positions section just for today’s trade history.

Funds

In the funds section, you will see your available fund for trading. Also, you will find an option for Deposit (Add Funds) and Withdraw.

Apps

In Apps, you will get different addon services which are paid products in Zerodha. These apps are integrated with the Zerodha/Kite trading platform.

How To Find/Add Stock in Zerodha/Kite?

To find and add stocks, available options, and commodities in Zerodha/Kite.

On the first page of Kite, you will see the Market Watchlist on the left side and the search bar.

In the search bar, you just have to type the name of the stocks, options (see how the option is labeled), and commodities.

After you type it will list the result, now either you can directly click on a name or you will get Add button to add to the Market Watchlist. Once you click to add, the stock will get added and it will list in your Market Watchlist.

You will get 5 to 7 pages for Market Watchlist.

How To Buy and Sell Stock In Zerodha/Kite?

To Buy and Sell stock in Zerodha/Kite, move the mouse cursor on the stock name then it will show other options, click on Buy, Buy window will get open. Enter quantity according to the available funds you have, select order type Market or Limit, and once done click on Buy.

After clicking to Buy, the Limit type of orders will list under the Orders sections and the Market type of orders will list under Positions. To sell the brought stock, for the same day you can sell from the Positions section, the holding stocks can sell from the Holdings section.

Zerodha Charges

Online account opening charges in Zerodha, Equity (for trades on Stock, F&O, and Currency) is Rs 200 for the Trading & Demat account. Enabling the commodity account is Rs.100. You can open an account by paying Rs 200, and the commodity account can enable later.

Currently, you need to add separate funds to trade Stock and separate funds to trade commodities. You can not use available funds in the equity to trade commodities.

Zerodha Charges For Trading & Investing In Equity/Stock.

| Charges | Equity delivery | Equity intraday | Equity futures | Equity options |

|---|---|---|---|---|

| Brokerage | Zero Brokerage | 0.03% or Rs. 20/executed order whichever is lower | 0.03% or Rs. 20/executed order whichever is lower | Flat Rs. 20 per executed order |

| STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | 0.01% on sell side | 0.05% on sell side (on premium) |

| Transaction charges | NSE: 0.00345% BSE: 0.00375% | NSE: 0.00345% BSE: 0.00375% | NSE: 0.002% | NSE: 0.053% (on premium) |

| GST | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + SEBI charges + transaction charges) |

| SEBI charges | ₹10 / crore + GST | ₹10 / crore + GST | ₹10 / crore + GST | ₹10 / crore + GST |

| Stamp charges | 0.015% or ₹1500 / crore on buy side | 0.003% or ₹300 / crore on buy side | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

Zerodha Charges For Trading & Investing In Commodity.

| Charges | Commodity futures | Commodity options |

|---|---|---|

| Brokerage | 0.03% or Rs. 20/executed order whichever is lower | ₹ 20/executed order |

| STT/CTT | 0.01% on sell side (Non-Agri) | 0.05% on sell side |

| Transaction charges | Group A Exchange txn charge: 0.0026% Group B: Exchange txn charge: CASTORSEED – 0.0005% KAPAS – 0.0026% PEPPER – 0.00005% RBDPMOLEIN – 0.001% | Exchange txn charge: 0.05% |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI charges | Agri: ₹1 / crore + GST Non-agri: ₹10 / crore + GST | ₹10 / crore + GST |

| Stamp charges | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

Zerodha Charges For Trading & Investing In Currency.

| Charges | Currency futures | Currency options |

|---|---|---|

| Brokerage | 0.03% or ₹ 20/executed order whichever is lower | ₹ 20/executed order |

| STT/CTT | No STT | No STT |

| Transaction charges | NSE: Exchange txn charge: 0.0009% BSE: Exchange txn charge: 0.00022% | NSE: Exchange txn charge: 0.035% BSE: Exchange txn charge: 0.001% |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI charges | ₹10 / crore + GST | ₹10 / crore + GST |

| Stamp charges | 0.0001% or ₹10 / crore on buy side | 0.0001% or ₹10 / crore on buy side |

How To Open Zerodha Demat & Trading Account?

Visit signup.zerodha.com and follow the instructions to open an account. Make sure your mobile number is linked with your AadhaarCard to open an account online.

Quick FAQ

- Is Zerodha a reliable stock broker?

- Yes, Zerodha is functioning since 2010.

- Yes, Zerodha is functioning since 2010.

- Investing a large amount in Zerodha is safe?

- Yes, Zerodha is functioning since 2010.

- Yes, Zerodha is functioning since 2010.

- Is ZERODHA a good platform for beginners?

- Yes, the Zerodha trading platform is light weighted and user-friendly.

- Yes, the Zerodha trading platform is light weighted and user-friendly.

- Account opening in Zerodha is Free?

- No, Equity (for trades on Equity, F&O, and Currency) is ₹ 200 + Commodity (MCX) ₹ 300. You can open an account by paying Rs 200, and the commodity account can enable later.

- No, Equity (for trades on Equity, F&O, and Currency) is ₹ 200 + Commodity (MCX) ₹ 300. You can open an account by paying Rs 200, and the commodity account can enable later.

- How Is the Zerodha Support Service?

- Supportive, address queries on time, and provide all possible information as per the issue.

- Supportive, address queries on time, and provide all possible information as per the issue.

- How to contact Zerodha Support?

- Support: Monday – Friday between 8:30 AM – 5:00 PM (080 4718 1888, 080 4718 1999)

- Call & trade: Monday – Friday between 9:00 AM – 11:55 PM (080 4718 1888)

Disclaimer: The above-mentioned brokerage and other charges can be change based on the terms by the brokers. The information posted on this page and in related products are mentioned based on the data available at the time of writing and same are believed through this page. However, in case, there is any discrepancy, please reach out to us so that we can edit or take necessary actions.